Esports Games Marketing Data

Dublin, July 19, 2019 (GLOBE NEWSWIRE) -- The 'Global Esports Market - Forecast up to 2025' report has been added to ResearchAndMarkets.com's offering

Global Esports Market Set to Triple by 2025

Esports is expected to grow with a CAGR of ~20% in the years between 2019-2025.

The Global Esports market is expected to cross $3 billion by the end of 2025 due to the growing popularity of Esports worldwide and the growing support of game publishers for Esports.

The aim of this report is to define, analyze, and forecast the Esports market based on segments, which includes revenue model, gender, audience, and region.

In addition, the report helps venture capitalists in understanding the companies better and make well-informed decisions and is primarily designed to provide the company's executives with strategically substantial competitor information, data analysis, and insights about the market, development, and implementation of an effective marketing plan.

The eSports market has boomed in recent years with more and more viewers tuning in to watch their favorite games being played by some of the best gamers in the world. By 2023, there are expected to. Other potential revenue streams in esports, and therefore opportunities for investment, include IT infrastructure and merchandising. Given the virtual nature of video games, IT infrastructure is critical to esports, and as 5G technology is rolled out over the next few years, the video game industry will see significant benefits. The global esports market size was valued at USD 1.1 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 24.4% from 2020 to 2027.

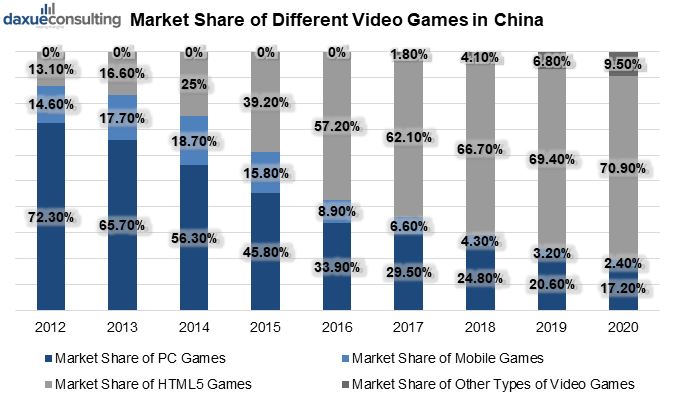

Esports is a potential market for the global gaming industry and it is experiencing a steady growth that is mainly driven by cloud gaming and mobile gaming. With the proliferation of smartphones with more and more processing power coupled with 5G network gaining popularity, In the same period, the gaming industry is expected to be more interactive and streaming-based. The countries that generate a major portion of the revenue in the gaming industry include China, Japan, US, Germany, South Korea, France, Canada, and UK.

Esports is gaining huge attention with many gaming events being telecasted on social media and streaming sites including YouTube and Twitch. Esports market is expected to cross $3 billion by the end of 2025 with major competitions occurring in games like Dota 2, Fortnite, and League of Legend. Real Time Strategy (RTS), Massive Online Battle Arena (MOBA), and First-Person Shooter (FPS) are the most common type of game genres witnessed in most of the Esports events.

The popularity of Esports has increased since 2010 with a greater number of revenue streams arriving in the form of merchandising and corporate sponsorships apart from traditional revenue streams like broadcasting rights of the event and tickets to the event. As of 2019, game streaming platform -Twitch is one of the major broadcasting mediums for Esports. Esports events including E LEAGUE Major, Genesis, Evo Japan, and WESG which generates more viewers for video game streaming platforms. Also, Esports events are providing more prize money for winners due to growing revenue streams.

North America is the leading revenue generator in the global Esports market with a major share of the market contributed by the US. North American market for Esports is mainly driven by a growing number of audiences for Esports and APAC is one of the fastest growing markets in the global Esports market with major growth being witnessed in China, Australia, South Korea, Taiwan, and Japan.

Based on the revenue model, the global Esports market is segmented into advertisement, sponsorship, media rights, and others. Others include game publisher fees and revenue generated from the sales of tickets and merchandise. Advertisement and sponsorship accounted for the major part of the revenue generated by the Esports market in 2018.

Based on audience, the global Esports market is segmented into regular viewers and occasional viewers. Regular viewers include fans and hardcore game enthusiasts who watch Esports regularly. As of 2019, regular viewers accounted for a major share in the market.

Based on gender, the global Esports market is segmented into male viewers and female viewers. As of 2019, male viewers especially those within the age group of 20-35 accounted for a major part of the market share.

The Esports market is primarily dominated by major companies that organize Esports events and game publishers. Some of the major vendors in the market are Cloud9, Team SoloMid, Team Liquid, Epic Games, Valve Corporation, Activision Blizzard, and Echo Fox. Other prominent vendors in the market include Fnatic, Gen.G Esports (formerly KSV Esports), 100 Thieves, G2 Esports, Immortals, Envy Gaming, Counter Logic Gaming, Nintendo, Tencent, Hi-Rez Studios, and EA Sports.

The market is expected to witness an increase in the number of audience and tournaments in the forecast period which may lead to a greater number of vendors (including game publishers and gaming organizations) entering in the market.

Esports Marketing Blog

Key Topics Covered

1 Executive Summary

2 Industry Outlook

2.1 Industry Snapshot

2.1.1 Industry Trends

3 Market Snapshot

3.1 Total Addressable Market

3.2 Segmented Addressable Market

3.2.1 PEST Analysis

3.2.2 Porter's Five Force Analysis

3.3 Related Markets

4 Market Characteristics

4.1 Market Ecosystem

4.2 Market Segmentation

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Growth in the Number of Revenue Streams for Esports Vendors

4.3.2 Restraints

4.3.2.2 Underage Esports Gambling Leading to Stringent Government Regulations

4.3.3 Opportunities

4.3.3.1 Growth of 5G Network and Increasing Investment in Live Game Streaming Services

4.3.4 DRO - Impact Analysis

5 Global Esports Market, By Revenue Model

5.1 Overview

5.2 Advertisement

5.3 Sponsorship

5.4 Media Rights

5.5 Others

6 Global Esports Market, By Audience

6.1 Overview

6.2 Regular Viewers

6.3 Occasional Viewers

7 Global Esports Viewers, By Gender

7.1 Overview

7.2 Male

7.3 Female

8 Global Esports Market, By Region

8.1 Overview

8.2 APAC

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 Rest of APAC

8.3 North America

8.3.1 USA

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 UK

8.4.3 France

8.4.4 Rest of Europe

8.5 RoW

8.4.1 South America

8.4.2 Middle East and Africa

9 Competitive Landscape

9.1 Competitor Analysis

9.2 Product/Offerings

9.3 Market Developments

9.3.1 Mergers & Acquisitions (M&A)

9.3.2 Expansions

9.3.3 Business Restructuring

10 Vendor Profiles

- 100 Thieves

- Activision Blizzard

- Cloud9

- Counter Logic Gaming

- EA Sports.

- Envy Gaming

- Epic Games

- G2 Esports

- Gen.G Esports (formerly KSV Esports)

- Hi-Rez Studios

- Immortals

- Nintendo

- Team Liquid

- Team SoloMid

- Tencent

- Valve Corporation

- Echo Fox Fnatic

For more information about this report visit https://www.researchandmarkets.com/r/xzqx3u

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Our new Q3 Global Digital Statshot report – published in partnership with We Are Social and Hootsuite – reveals that almost 1 billion people around the world are already watching video game tournaments.

Data from GlobalWebIndex shows that ‘esports’ audiences have grown by close to 50 percent over the past year, with 22 percent of all internet users saying they’ve watched a video game tournament in recent months.

Esports win with younger audiences

The number of 16 to 24-year-olds watching esports is growing even faster, with the latest data suggesting that global audiences in this age group are up by more than 60 percent since this time last year.

The latest numbers also suggest that interest may have reached a tipping point. 32 percent of internet users between the ages of 16 and 24 now say that they watch esports, compared to 31 percent of the same age group who say that they’re interested in watching more ‘conventional’ sports like football, cricket, or motor racing.

Major league success

An overall audience of 1 billion people doesn’t quite match the 3.5 billion people who watch the Olympics or the FIFA World Cup, but you may be surprised to learn just how big esports have become.

For context, the global esports audience is already:

Double the size of the global audience for Formula 1 motor racing;

8 times bigger than the TV audience for the baseball World Series; and

10 times bigger than the number of people who watched the 2019 Super Bowl.

GlobalWebIndex also reports that people spent more than 6 billion hours watching esports in 2018, up by almost a fifth since 2015.

Rebalancing the playing field

Interest in esports still isn’t evenly distributed though, with people in Asia much more likely to be fans.

Esports Games Marketing Data Sheet

40 percent of internet users in China – equivalent to more than 300 million people – already report watching esports, while one-third of internet users in Vietnam say they’ve recently watched a video game tournament.

However, it’s taking longer for the trend to catch on in the West. Less than 10 percent of internet users in North America and Europe watch esports today, which may explain why marketing budgets continue to lag.

But that may soon change. The industry is already worth more than $900 million, and PwC believes that sports have greater growth potential than the NFL. Top US sports celebrities like Stephen Curry have already invested in esports companies, and it seems like it will only be a matter of time before video game tournaments gain traction in the West.

Casual spectators

The potential of esports extends well beyond big tournaments too, as the popularity of streaming platforms like Twitch demonstrate.

GlobalWebIndex’s latest data show that nearly 3 in every 10 internet users now watch live streams of other people playing video games, equating to a global audience of close to 1.25 billion people.

Twitch alone boasts 140 million monthly active users, with 15 million people tuning in to watch live game streams every day. These viewers are typically young and affluent – a particularly appealing demographic for marketers.

So how can brands get in on the game?

The marketing opportunity

With roughly 1 in 6 adults around the world already watching video game tournaments today, and with tens of millions of new spectators starting to watch every month, the esports opportunity only looks set to grow.

Gaming enthusiasts are a notoriously tough audience though, and the size of the esports audience isn’t the only thing that marketers need to consider. As with all sports marketing, the secret to success involves understanding your audience’s motivations for watching, and identifying how you can actively enhance their enjoyment.

Simply sticking a logo on the hoardings won’t endear your brand to savvy esports fans; you need to deliver something that makes the audience’s experience better than it would have been without your brand’s involvement.

However, you don’t need to be a headline sponsor to achieve this. A great example of targeted sports marketing is Omega’s role as the official timekeeping partner of the Olympics. The brand provides technical excellence for one of the most important aspects of the Games – identifying who actually won – while simultaneously offering clear, relevant visibility for the brand in moments when the audience is most likely to be engaged.

That’s the kind of win-win you’re looking for in esports marketing: activities that actively add value to the audience’s experience, as well as to your brand’s bottom line.

If you’re looking for more great insights into the current state of digital around the world, check out the other stories from this quarter’s update. You can also dig into the full report in the SlideShare embed below.

','resolvedBy':'manual','resolved':true}'>